7 tips to improve cash flow in a manufacturing business

It doesn’t matter what industry you’re in. As a manufacturer, you need to have a stabilized cash flow. The dynamics of the modern market dictates that you do. Cash flow basically refers to the coming in and going out of money in your business.

With increasing competition, globalization, and raw materials that keep getting costlier, you already have a lot on your hand. While you’re still battling these challenges, here comes customers that want higher product quality—for lesser price of course!

By now, you don’t have to be told that you need to connect your business with regular cash flow. A positive cash flow means you can continue running and growing your manufacturing company. A negative one means — well, you can guess.

Yes, don’t we all love positive cash flow? No doubt that is the dream of every manufacturer. How does the dream get actualized in reality then? How do you keep the positive cash flow coming in? What should you do to put a stop on that negative cash flow and turn the table around? This article answers it all, with more.

Table of Contents

Common cash flow challenges in the manufacturing industry

A wide number of factors can make your bank account very lean. For the manufacturing industry, here are a couple of common challenges that require cash flow management:

Imbalanced business cycle length

The phases involved from setting up shop to buying raw materials, to selling, then to actually getting your profit may be a very long and difficult one. You’ve invested a lot of capital in the production process, yet it’s going to take a long while for you to start getting paid. This is so whether or not you run a cash on delivery (COD), 30 day end-of-month (EOM), 60 day EOM, or other suitable plans.

While you’re in this, you have to keep the manufacturing wheel going. You still have to finance the cost of further production. You may also be dealing with numerous suppliers that you have to pay immediately. The implication of all these is that things may get really tight in between manufacturing goods and getting the returns.

High cost of production

Excess production cost will always affect your cash flow. The cost of production isn’t just about raw materials. Energy bills, payment of wages, running logistics, etc., also form part of your production cost.

When the cost of production is high, your profit will be lessened. If the poor profit is not easily addressed, it will lead to negative cash flow. The immediate effect of this is that you’ll start juggling payment of bills, you’ll start deferring paying your suppliers or employees.

If you’re going through this, you should really learn how to cut the cost of production.

Credit term squeeze

Terms of credit are getting more constricted. This could happen to anyone. One of the economic effects of the pandemic is that credit lines are feeling the heat. The first concern is that your suppliers may now demand a faster payment plan. On the other end, your clients or consumers may further worsen matters. They may delay payments or even propose a revised payment plan that will further extend payment dates.

Whichever view you look at it from, your business cycle is already affected. On both scales, the result is less cash flow and more financial stress.

Changing business climate

The evolving business climate has necessitated a lot of ‘expected’ shifts in the manufacturing industry. It doesn’t come as a surprise because business patterns evolve every time. In some cases, some products may suddenly gain popularity and increase in market demand. In other instances, some goods that were once essential and in hot demand may lose their sensation.

Also, overseas (and even domestic) supply chains are not as easy as they used to be to navigate. With the pandemic, the cost of transporting or importing raw materials from overseas is getting more difficult and volatile.

The well-known uncertainty of current economic and social conditions has caused a lot of problems for the manufacturing industry.

With the never-ending challenges that pressure businesses every day, it has now become more important to look into ways of boosting that cash flow and making sure your business stays afloat. Here are 7 ways to go about this.

7 ways to boost your cash flow in the manufacturing industry

The money will not just flow in miraculously. As the owner of a manufacturing business, you have to put in place several methods and inventory levels to ensure your books get stabilized. You must first note that the key to doing this is not just in sourcing for cash inflow. Limiting cash outflow is equally as important to your business.

We have identified 7 ways you can boost the cash flow in your manufacturing company. Here they are:

1. Send the invoices right away

When you make sales, you have to issue invoices. If you don’t send invoices, chances are that you won’t get paid. It is simple business logic that the quicker you send out invoices, the quicker the payment comes in.

Make sure you stay on top of invoicing your customers. The quicker you send invoices out, the faster the cash comes in.

You can’t ever be too busy to issue the invoices. This is also an important part of running a manufacturing business.

2. Get customers to pay invoices as and when due

What’s the point of sending out invoices if the customers are not redeeming them? If the invoices are not paid as and when due, it’s no doubt going to put a strain on your cash flow. Of course, it’s not an easy thing trying to get customers to pay their invoice. This hinges on a lot of factors that are usually beyond your own control. With the right strategy however, you may be able to induce your customers to pay the invoice quite faster.

Some of the tricks you may put to good use include:

- Do a follow-up: While you’re busy running your business, your customers are busy running their own affairs too. It is very possible that they forgot to redeem the invoice. Or maybe not. Whichever way it goes, you stand a bigger chance of getting your customers to pay the invoice if you send out ‘gentle reminders’.

You can do this by sending an SMS or mail a couple of days before the invoice is due. Then you have to send reminders the day the invoice is due, and keep sending it days after it is due. If the invoice still remains unpaid, you may have to resort to calling them.

- Offer incentives for early payment: Another way you can induce your customer to pay the invoice is by sweetening the deal for them. You can offer a discount or incentive to those that can pay their invoice at a specified earlier date.

In some instances, the invoice may be due 30 days after it is sent. You may however offer your customers a juicy deal if they can redeem the invoice the first week after it is sent. Surely, earlier payments equals more cash flow.

- Penalize late payment: This may seem a little above the edge, but it sure is a working strategy. Putting up a strict invoicing strategy is one of the things every manufacturing industry should be doing. When you issue out an invoice, you also have to attach a penalty for late payment to it. Of course, this is not something that can be done with informing the customers. Asides putting it in the terms and condition, you also have to inform them directly of the specific due date and the charges that may accrue after the expiration.

Engaging this tactic will not only increase your chances of getting paid, it’ll also help lessen your chances of having customers who don’t pay on time.

- Consider Invoice Factoring: Invoice factoring is a debtor finance transaction that involves selling your accounts receivable to a third party at a discount. Businesses do this when they are pushed to a corner and have to meet a present and immediate cash need. You may also do this if you’re in such a position. Sure, you’re selling the ‘yet-to-be-paid’ invoice for a discount. But this will at least make sure you can infuse cash into your business and move on, rather than being run to the ground because your customers couldn’t pay on time.

3. Reevaluate production costs

This is undoubtedly one of the major ways you can increase your cash flow. A sizable chunk of your cash outflow is channeled towards financing the cost of production. If the cost of manufacturing your products is higher than they should be, you’ll run into financial problems.

Business logic dictates that you have to get more money flowing in and less money going out. Thus, you have to look for more ways to spend less on production cost—without reducing the quality of your products of course. Here are some of the ways you can go about this:

- Don’t spend unless you have to: Of course, you know this already. But this should serve as a reminder. Examine your cash outflow and find out the places where you spend more money. Were the expenses really necessary? Are there less expensive and equally efficient options you could have taken? These questions will lead you to putting a plug on some unnecessary expenses.

- Purchase more efficient equipment: Some of your equipment may be old and costing you more time or resources to maintain. You’ll do better purchasing upgraded equipment in your manufacturing industry. In the short run, it may look like an additional expense. The long run will however prove you right. Not only will you save time or cut back on wage expenses, you’ll also increase your production rate.

- Consider Leasing Equipment: Admittedly, investing in new machinery may not be the bright idea you need now. To save cost and boost your cash flow, you can consider leasing the equipment you need, rather than buying them or taking a loan. This is a rather temporary alternative you have at your disposal. Though the equipment cannot be listed as one of your assets, the advantage of getting the equipment you need (without actually buying them) is yours to take.

4. Increase the price of your products

You may be experiencing a cash flow crunch because the prices you set for your products are too low. Perhaps you had to lower your prices at a time because you wanted to bring customers to your business. During this time however, prices of raw materials and other cost of production have increased—and hence your negative cash flow.

This may be the right time to consider a markup or margin analysis of your products. To determine whether or not your prices are fair or competitive, you’ll have to find out:

- What your competitors are charging for competitive products.

- If and how the prices of raw materials you use have increased?

- Whether you can derive profit if you still maintain the same price?

It is important that you find a balance in your pricing strategy. Not only should your products not come off as too expensive or too cheap, you must also continue to give your customers the quality they expect.

If the price of the product is not the reason you’re cash-strapped, there’s no really no need to increase the prices. You will have to look for other alternatives.

5. Expand your target market and sales

The more products you’re able to sell, the higher your income. If the reason you’re cash-strapped is because you’re not selling enough products, then you have to find a solution to that. You may be selling less because the demand for your product suddenly dropped. Brainstorming for fresh ideas to get your manufactured products sold should put you on the green side of the book.

Here are a couple of tips to boost sales and increase your income:

- Add new services or products: Is it possible that you’re underutilizing your production line? Perhaps your manufacturing business has invested so much in equipment, yet you’re not churning out products as much as you can. You may be getting a negative cash flow because the products you’re manufacturing are not enough to offset the cost of production.

When this is so, you might have to consider producing more products or adding more products or services to your business. You have to get creative about other ways to generate income without having to overstretch your cost of production.

- Create an ‘aggressive’ marketing strategy: Okay, your products are awesome. Why aren’t you selling as much as you should then? Well, it’s most likely because you’re not putting your products ‘out there’. Maybe spending a little on market publicity will help solve this. You have to widen your target market and offer your goods to a new market.

- Induce your customers to buy more products: You can boost your sales and cash flow by putting in juicy offers that will encourage your customers to buy more from you. There are several ways you can go about this. Some of these include offering discounts on bundle items or advertising “related products'' on the e-commerce platform you’re selling on.

Rather than adding new products to your production line, inducing your existing customers to buy more from you may help solve the cash flow problem.

- Reward your regular customers: You might be experiencing a negative cash flow because you’re losing your loyal customers. So why not reward them with exciting offers? You can put in place programs like discounts on bulk purchases. Likewise, a program where you offer a reward for referrals will also help boost your sales.

6. Liquidate old inventory

Having too much inventory is one of the major problems that manufacturers face. Other than taking up storage space, excess inventory also chokes your cash inflow and keeps you from expanding your business. This identifies why you need to pay extra attention to your product sales and inventory.

Check your sales patterns to determine your busy and non-busy sales products or periods. How fast do some products move? Are some of your products seasonal? The answers you get from these will help you learn how to move out your old inventory.

You can liquidate your old inventory by:

- Refreshing or remarketing them,

- Putting a discount on them,

- “Bundling” the old inventory together with moving products,

- Offer them as incentives to increase sales on your other products.

7. Strategize when you pay off your vendors

One business tactic important to your manufacturing company is learning how and when to pay off vendors. The first rule is to always take advantage of early payments that come with a discount. If there’s incentive to pay early, well… pay when it’s most convenient for you.

For instance, assuming January is a slow month for your business and you have a bill due for January 31st, you can consider pushing off paying off your vendors to February (a month you experience a boom in sales).

Ways to make payment on Alibaba.com, the cheapest and safest

Once you have negotiated the price and minimum order quantity, you will want to figure out the best way to pay the supplier. There are many different payment methods, each with advantages and disadvantages for both the buyer and the seller.

The common methods to pay on Alibaba are PayPal, wire transfer (T/T) or by debit/credit card.

PayPal

- Can't be used in conjunction with Trade Assurance

- Limit $12,000

PayPal is a popular payment method for buyers, as it offers ease of use and affords some limited payment protection with the ability to open a dispute if there is a problem.

Debit/credit cards

- Available when paying supplier direct, or via Trade Assurance

- Limit $12,000

Alibaba secure payment allows payments via credit and debit cards issued by Visa, MasterCard, American Express and others.

This is a popular payment method for buyers as it offers ease of use and does not require setting up additional payment methods or services. However, keep in mind that there is a maximum transaction amount for orders paid via credit card. In addition, credit card companies charge a higher transaction fee and less desirable exchange rate compared to T/T payments.

Wire transfer – T/T

- Available when paying a supplier directly, or via Trade Assurance

- Make payments without worrying about restrictions for large orders

Depending on your international payment provider, this can be the cheapest option. If used in conjunction with Trade Assurance wire transfers can give buyers the best of both worlds, offering security and peace of mind, as well as cost effectiveness.

How to pay using WorldFirst International Wire Transfer

Service available in United Kingdom

Step 1: Access the Alibaba payment platform through:

- Option 1: “All Orders” Page: Find the order you would like to pay for and click “Make payment”

- Option 2: Order details page: Select “Make payment”

- Option 3: Payment links: Get directed to your order when your supplier shares a link in Message Center

Step 2: Select “Wire transfer”, then select “International wire transfer”. Verify your payment amount information and select “View account information”.

Step 3: Download or print the international wire transfer account information page. This has the important information you will need to set up a payment beneficiary.

Step 4: Complete the wire transfer via the WorldFirst online portal or over the phone with one of our dedicated relationship managers who have extensive experience to support with your China payments. Make sure to include your alibaba.com order ID in the remarks.

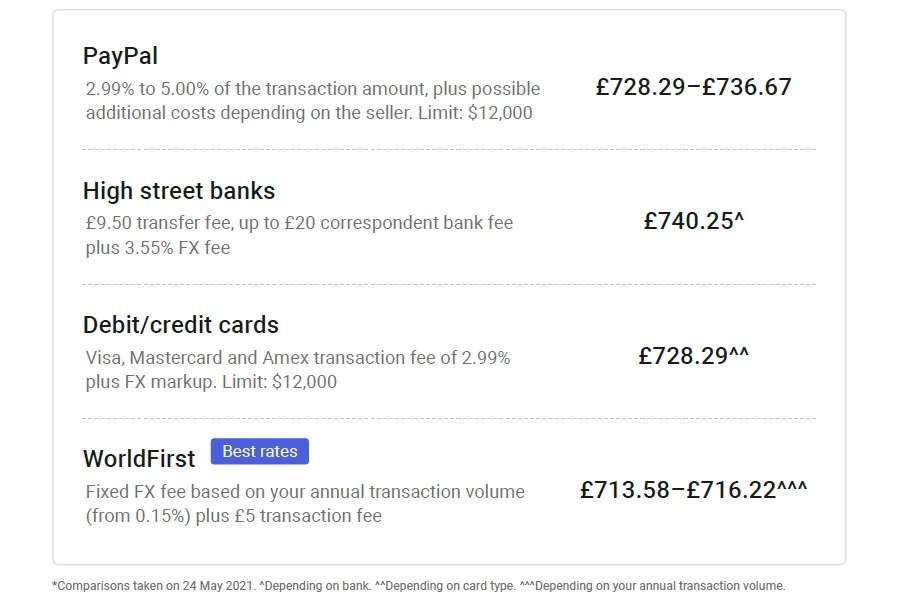

Average cost to send $1,000 to an Alibaba supplier USD account from GBP

Sell on Alibaba.com to increase your manufacturing sales

Without it being said, it is clear that the number one trick to increasing your cash flow is by boosting your sales.

Where else can you do this than on Alibaba.com - an international e-commerce platform that offers you access to millions of international buyers. Alibaba.com provides a marketplace where you can sell to millions consumers and retailers all over the world.

Start your borderless business here

Tell us about your business and stay connected.

Keep up with the latest from Alibaba.com?

Subscribe to us, get free e-commerce tips, inspiration, and resources delivered directly to your inbox.