What is HS and HTS code?

What is HS Code and HTS Code?

HS and HTS Codes are widely used in the world of international trading. HS Code stands for Harmonized System Code and HTS Code stands for Harmonized Tariff Schedule Code.

HTS and HS Codes were both developed by the World Customs Organization (WCO) and are used to classify and define internationally traded goods. In order to import or export a product internationally, your traded goods must be assigned an HTS Code that corresponds with the Harmonized Tariff Schedule of the country of import.

The difference between an HS code and HTS code is the number of digits within the code. A code with six digits is a universal standard (HS Code) and a code with 7-10 digits (HTS Code) is often unique after the sixth digit and determined by individual countries of import.

Let’s take a closer look at HS Code and HTS Code.

Harmonized System Code (HS Code)

The Harmonized System Code, or “HS Code” for short, refers to a six-digit standard classification code of goods. It’s used around the world and acts as the main way to facilitate the simplification and harmonization of the customs procedure.

Today, customs officers worldwide must use the right HS Codes in order to accurately identify traded products so that they can allocate the correct rate of duty and tax. This helps to clear every commodity that enters or crosses any international borders.

The Harmonized System categorizes about 5,000 commodity groups. Those groups are arranged into 99 different chapters, that are grouped into 21 sections.

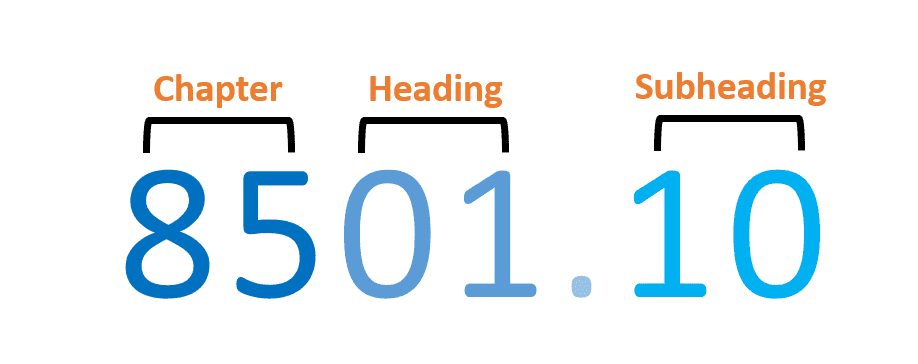

Summed up, the six-digit HS code can be broken down into three parts:

- Chapter: the first two digits identify the chapter. It gives a rough indication of the product, and refers to the various chapters of the list. Currently there are 99 chapters. In the example above, the chapter 85 stands for “Electrical machinery, etc.”

- Heading: the next two digits identify the heading, which helps to further identify the specific category within the chapter. In the example above, the heading “01” refers to “Electric motors and generators.”

- Subheading: the last two digits identify the subheading, defining more specific subcategories of the products. In the example above, the subheading “10” refers to “Electric motors, of an output not exceeding 37.5W.”

Countries are allowed to add an extra two to four digits after the six digits to further break down the classification, and those numbers are called Harmonized Tariff Schedule (HTS) Codes.

Harmonized Tariff Schedule

The Harmonized Tariff Schedule of the US1 is a nomenclature system used to classify traded goods for import categorization. This is based on their material composition, product name, and/or intended function. An HTS Code is a 10-digit code specifically designed to ensure each article falls into only one category. It takes the first six digits from the international HS code, and adds an extra four digits for further definition.

US Customs uses these rules set out along with this system to classify imported goods. HTS Codes can also be used to determine any duty rates applied to imported goods.

As a result of the HTS code system, importers are immediately able to establish the appropriate tariff and duty for any given shipment. If you’re planning on importing goods into the US, you will need to find the right HTS code to fill out related paperwork.

Schedule B Code versus HTS Code

In the US, a Schedule B number is a 10-digit number used to classify physical goods for export to another country, with the first six digits being the HS Code.

The initial six digits of HTS Code (which is the HS Code) and Schedule B numbers will always be the same for particular products. Though Schedule B Codes and Harmonized Tariff Schedule Codes may seem very similar, HTS Codes are used for import categorization and Schedule B Codes are used for export categorization. Another key difference is the number of codes. There are approximately 19,000 HTS Codes, compared to about 9,000 Schedule B Codes.

The US Census Bureau provides a free online Schedule B search tool that you can use to look up Schedule B Codes for your products. Check it out at: https://uscensus.prod.3ceonline.com/

Is HS Code the same for all countries?

HS Code is a universal code name that is used in more than 200 countries around the world, and more than 98% of trade merchandise is being classified with these codes. In other words, the six-digit HS Code is the same in almost every country in the world.

Each country can then add an extra two or four-digit code to the original HS Code to suit its own tariff and statistical purposes.

Why as an HS Code important?

HS Codes are important because they determine the tariff or duty rate of the traded products, and also help government customs authorities keep a record of international trade statistics and perform analyses for legal, economic, or trade negotiation purposes.

HS Codes are also important for companies and business owners. Importers and exporters may sometimes underestimate the importance of using HS codes. However, Harmonized System Codes are vital when it comes to saving you time and money. By coming to terms with how the classifications work, you’re also fulfilling your legal responsibilities when it comes to trading on an international scale. Failing to use HS Codes correctly can lead to legal issues and is bad business practice. Here are just some of the issues that may occur when HS Codes are either not assigned properly or not assigned at all:

- Costly effect on duty rates: providing an incorrect HS Code, or not providing one altogether, could be commercially risky and may affect your duty rate.

- Risk of relays: delays and storage charges may occur when custom brokers are not able to classify or identify a shipment correctly by using the right Harmonized System Codes.

- Overpaying or underpaying: you could pay too much duty or being fined for inaccurately using HS Codes. If your duty has been overpaid, you will not receive a refund, as this is your error. If underpaid, you will be forced to pay the difference and await any fines/charges customs may implement.

How to find and check an HS code

To find and check a Harmonized System Code, you need to start by finding an HS Code list. Different countries around the world may have different versions of the Harmonized System Code list, but the first six digits will always be fully harmonized. With a quick search, you’ll find plenty of websites that will help you with your search in finding your product codes.

Once you are on a website that you trust, you need to find a description that’s closest to your product. In some cases, you might not be able to find an exact description, however, there are options to use the ‘other’ selection as a description.

If you’ve managed to find your HS Code, you will now be able to view what the import duty will be for your product.

Now that you have your HS Code, how do you use it?

Your goal is to set up a classification process using the Harmonized System Code that will be efficient, demonstrate reasonable care, and ensure you’re using the lowest possible duty rate.

In taking the first step toward achieving this, you may find the below steps useful:

- Break down your item’s universe: begin by breaking down your item’s universe into specific product groupings. This first step is critical to ensure efficiency and control for maintaining the integrity of the data.

- Do your research: whether this is a product you have been selling locally for years or you’re looking to globally source a new one, you should always check the rulings. Browse the web to see if there have been any changes in logic, new rulings, revocations, or regulations.

- Identify product specifications: now that you have a starting point in the world of HS Code, you should be able to find the relevant information required in order to assign the best possible classification. You can now request any product specifications from your supplier.

Want to know more about how Alibaba.com can help you trade globally and expand your business? Speak to an expert now.

Further reading on international trade:

- Differences between domestic and international trade

- Local versus global sourcing: the pros and cons

- How to find international buyers for your start-up export business

Reference:1. https://hts.usitc.gov/current

Start your borderless business here

Tell us about your business and stay connected.

Keep up with the latest from Alibaba.com?

Subscribe to us, get free e-commerce tips, inspiration, and resources delivered directly to your inbox.