Delivered Duty Paid (DDP)

Here we’re reviewing the Incoterm “Delivered Duty Paid,” abbreviated as DDP.

What is the Incoterm “Delivered Duty Paid” (DDP)?

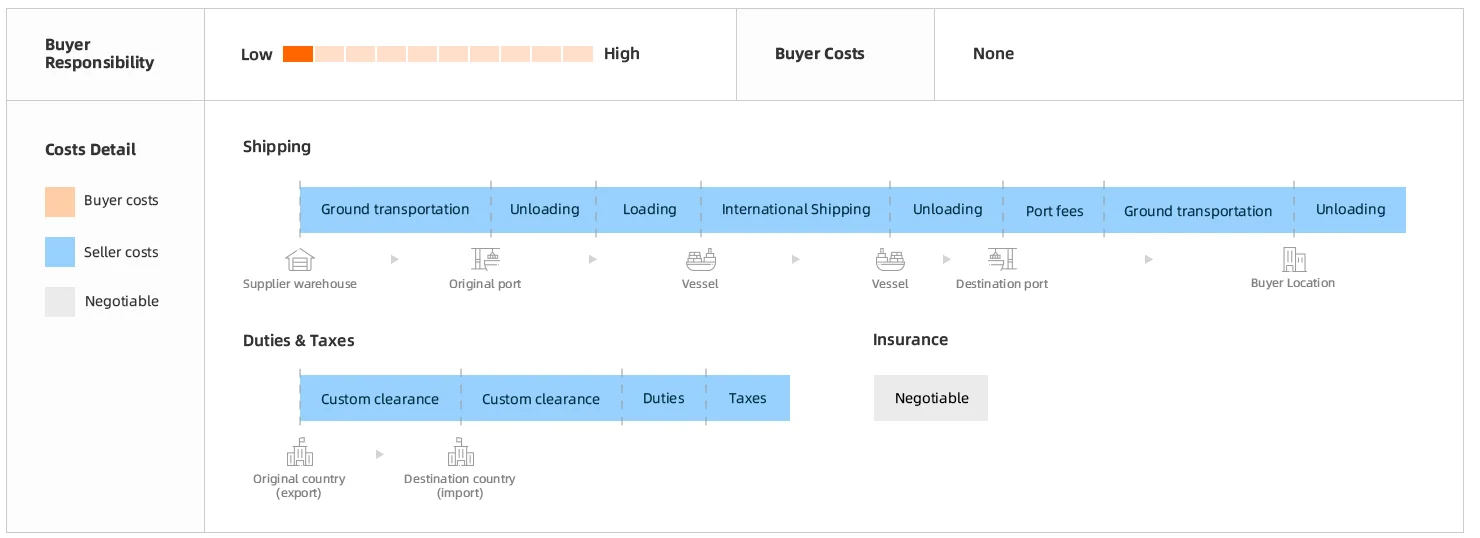

A Delivered Duty Paid (DDP) shipping agreement is the Incoterm that places the maximum obligations on the seller and minimum obligations on the buyer.

In a Delivered Duty Paid (DDP) arrangement, the seller delivers the goods to the named place in the country of the buyer, with import duties paid, including inland transportation from import point to the buyer's premises.

That means the seller has goods available in the country of import and pays all costs including import duties, taxes, and other charges related to delivery, cleared for import.

A DDP transaction will read “DDP named place of destination”. For example, assuming goods imported through Baltimore are delivered to Silver Spring, the Incoterm would read “DDP, Silver Spring”.

DDP Cost Details

Seller’s responsibility

While EXW (Ex Works) represents the minimum obligation for the seller, DDP represents the maximum obligation. And the onus for responsibility, cost, and risk lies squarely on the shoulders of the seller.

As mentioned above, the seller (exporter) is responsible for all costs involved in delivering the goods to a named place of destination and for clearing Customs in the country of import. Under a DDP Incoterm, the seller provides literally door-to-door delivery, including customs clearance in the port of export and the port of destination. Thus, the seller bears the entire risk of loss until goods are delivered to the buyer’s premises.

The seller may also need to obtain import licenses, permits, or certain payment options with the Customs. If the seller is unable to obtain an import license, DDU (Delivered Duty Unpaid) term should be used instead of DDP (Delivered Duty Paid).

Buyer’s responsibility

In a Delivered Duty Paid shipping agreement, the buyer has minimal responsibilities. These are to unload the goods at the prearranged point of transfer and to freight them to their final destination.

The buyer is not required to help or advise the seller on import responsibilities or any other documentation, nor does the buyer accept any risk during shipping under this arrangement.

Seller’s benefits

As with any shipping Incoterm system in which the seller controls the export of the goods, a DDP arrangement allows the seller to control the logistical costs and adjust them accordingly in order to maximize profit.

It also allows the seller to choose which shipping service is willing to offer the biggest commission for the contract. These benefits are not necessarily passed on to the buyer.

Buyer’s benefits

For an inexperienced or busy buyer, the benefits of Delivered Duty Paid are myriad. As, mostly, the whole responsibility for the freight and paperwork of the goods is down to the seller, it gives the buyer a chance to arrange for the sale or use of the products he/she is about to receive.

The buyer enjoys a hassle-free situation as he/she has very little in the way of responsibly until the goods fully arrive.

DDP compared to DAP

DAP (Delivered At Point) differs from DDP in that under DAP, the buyer is responsible for customs clearance, duties, and taxes. Whereas, under DPP, it is the seller’s obligation to clear the goods and pay for the import duties and taxes.

DAP is more useful for goods transport when there is no necessity to clear the goods at borders or customs. One of the benefits of DDP for buyers is that all the documentation is taken care of, whereas with DAP there is far more paperwork to deal with for buyers.

Considerations for Importers and Exporters

A Delivered Duty Paid shipping agreement is more useful for buyers that have very little in the way of shipping knowledge and want a hassle-free experience. An experienced seller also benefits from this system as they would have total control over costs, including factors that could maximize their profit.

Importers/buyers who have more experience are more likely to avoid this shipping agreement, as they are more likely to have more cost-effective ways of importing their goods. These companies will have a network of responsible agents that can capably deal with the buyer’s demands. The DDP shipping agreement is more suitable for buyers that have not managed to form these relationships yet, or do not import very often and so go for the most trouble-free shipping system. Generally speaking, we don’t recommend DDP for ocean shipping. However, it is more common and makes more sense for air express or parcel shipping.

Grow your business with experts in global trade.

Want to know more about how Alibaba.com can help you trade globally and expand your business? Speak to an expert today.

Start your borderless business here

Tell us about your business and stay connected.

Keep up with the latest from Alibaba.com?

Subscribe to us, get free e-commerce tips, inspiration, and resources delivered directly to your inbox.