How MSMEs survived the pandemic: Alibaba.com survey

The pandemic affected many businesses across the world. Some businesses excelled, but unfortunately, many others failed. B2B suppliers were in for an especially wild ride as they had to work quickly to bend to the ever-changing needs and demands of B2B buyers.

In an attempt to better understand the implications of operating Micro, Small, and Medium Enterprises (MSMEs) for over two years of the pandemic, Alibaba.com put out a survey to learn more about how different global suppliers navigated the pandemic.

A few of the questions the survey asked included:

- After the pandemic, do you believe that Alibaba.com is still valuable to small business owners?

- How did the pandemic impact your trading business, being an MSME, in recent years?

- What did you do to sustain your business during the pandemic?

- In terms of improving business environments, what [do you] most expect from other sectors of society?

The survey also gathered data on company size, location, and business type to better understand who the respondents are.

Our main goal with the survey was to understand the effects of the pandemic on global suppliers and assess how they navigated the trials and tribulations of the last two years. We also wanted to determine how important B2B e-commerce was for MSMEs during this time.

Since history tends to repeat itself, documenting how different types and sizes of businesses fared through this global crisis will better equip businesses to navigate crises of similar magnitude in the future.

In this report, we will discuss the findings of the Alibaba.com small business survey for global suppliers. We will review how the pandemic affected MSMEs and how these businesses survived the pandemic. We will also discuss the importance of e-commerce marketplace to MSMEs after the pandemic and what MSMEs expect for future support.

Table of Contents

Who participated in the survey?

Alibaba.com received survey responses from over 1000 B2B suppliers from around the world. This group is made up of both latent customers and in-service customers, so the past or present use of Alibaba.com was the commonality among all respondents.

Asia was by far the most prevalent location of the suppliers who filled out the survey. The most common countries represented by respondents include India, Pakistan, Turkey, Japan, Indonesia, Italy, Canada, Malaysia, Vietnam, and the United States. There was representation from every inhabited continent of the world.

Respondents were able to indicate the size of their organization based on the number of employees that they have. They had the option to choose 0-10, 10-50, 50-250, or 250+. The vast majority of respondents, or precisely 95%, were MSMEs with less than 250 employees, and 80% of the respondents had less than 50 employees.

Manufacturers take the highest percentage of survey responses, accounting for more than 60%. The other 40% of respondents were trading companies, distributors, and entrepreneurs. Trading companies accounted for 17.5% of total respondents, and distributors and entrepreneurs accounted for 7.8% and 14%, respectively.

Understanding who participated in this survey is important because it allows us to recognize the true scale of the effects of the pandemic on B2B businesses.

How the pandemic affected MSMEs

As we mentioned, the pandemic affected everybody differently since each nation had a unique response to the coronavirus. Some countries simply locked down their borders whereas others limited all “non-essential” operations.

However, the global restrictions and disruption did spark some widespread shifts that were felt around the world. Global demands shifted, lockdowns sparked shortages, and e-commerce became a major in B2B trade.

Businesses of all types and sizes were forced to quickly adjust their operations to navigate things that were thrown their way. Many had to pivot within their industry in order to survive. For many businesses, the issues caused by the pandemic were simply too much.

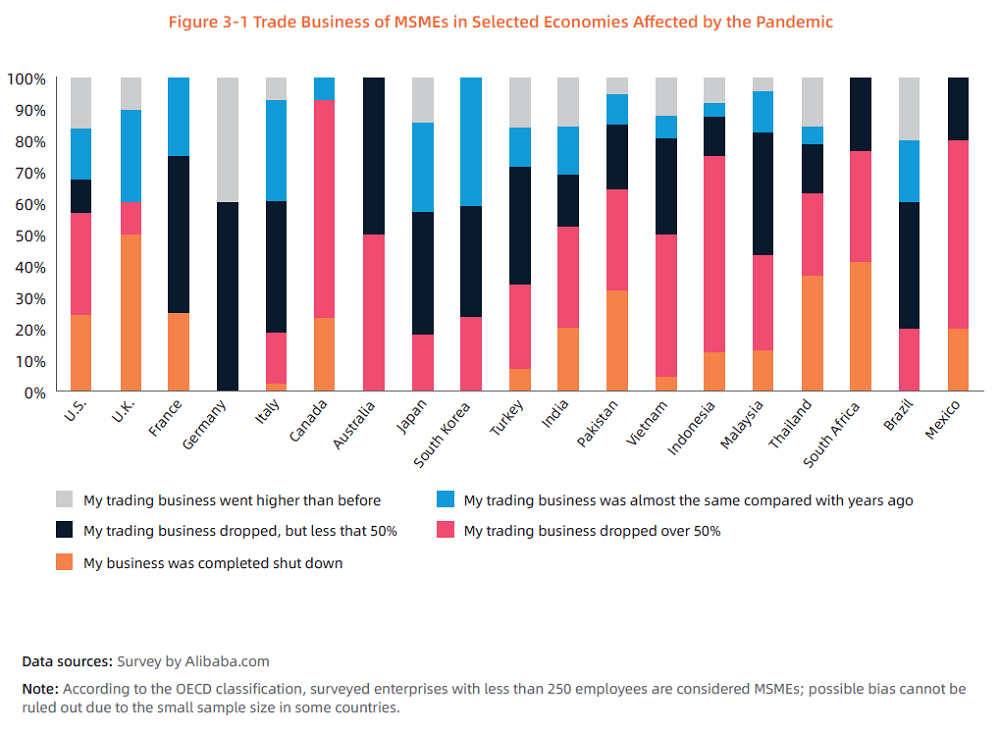

In general, over 55% of respondents saw their revenue drop, and 20% report that they shut down altogether. However, almost 15% of respondents report that their businesses stayed the same, and 10% of respondents saw their business rise instead of fall.

Let’s take a closer look at how businesses with different sizes, types, and locations fared through the pandemic.

Effects of the pandemic on MSMEs by company size

The pandemic had more negative effects on smaller MSMEs. For example, 25% of survey respondents with under 10 employees shut down completely, whereas only 13% of respondents with over 250 employees had the same results.

In addition to lower shutdown rates, 17% of respondents with more than 250 employees reported that the pandemic left their businesses better off than before. This is nearly double the success of businesses with under 10 employees. Only about 9.8% of respondents in the latter category reported that their businesses were better off than before the pandemic.

Respondents with 10 to 50 employees and 50 to 250 employees had very similar results to one another. Both were better off than smaller companies but worse off than larger companies.

From this, we can deduce that larger MSMEs with more employees were better off throughout the pandemic. This is not to say that larger B2B companies went unharmed as a whole, but they were more likely to survive the pandemic than their smaller counterparts.

Effects of the pandemic on MSMEs by business type

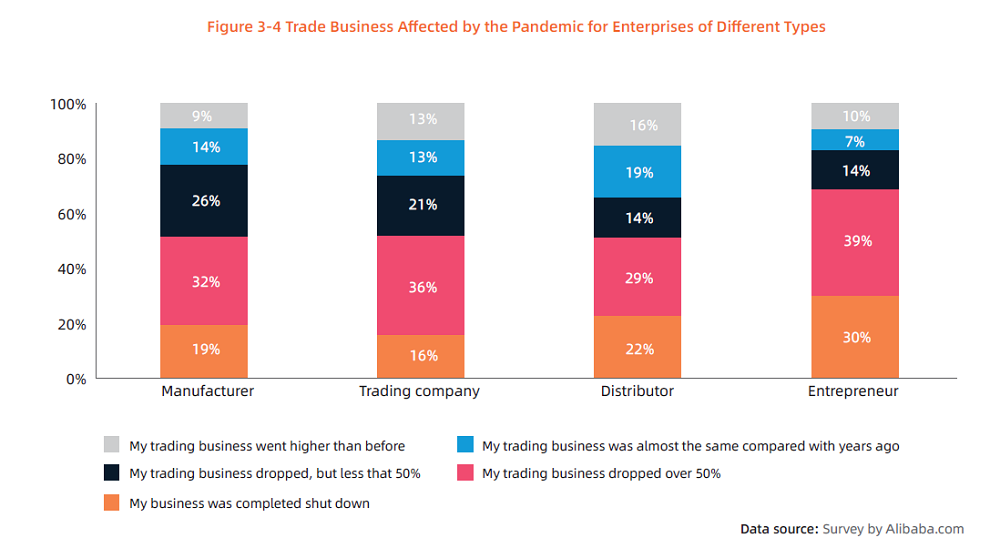

The survey received responses from four different types of businesses, and each type had slightly different outcomes after experiencing the damages of the pandemic. Surprisingly, there was very little correlation across the board.

Based on the results of the survey, trading companies had the lowest percent of shutdowns at 16%, and entrepreneurs had the highest at 30%. Manufacturers and distributors fell somewhere in between with 19% and 22% of respondents shutting down, respectively.

However, when it comes to businesses remaining unaffected or doing better, distributors were the best off with over 35% of respondents having a positive outcome. Unfortunately, of the respondents who were entrepreneurs, only about 17% had a positive outcome. About 23% of manufacturers and 26% of trading companies had favorable results.

How businesses survived the pandemic

The pandemic brought forth a plethora of unprecedented issues and situations, so businesses had to get creative to survive the ups and downs.

Some of the ways that businesses survived the pandemic included:

- Expanding sale channels

- Exploring e-commerce or digitalization

- Controlling the business’s finances

- Investing in research and development to upgrade products

- Seek support from local governments or institutes

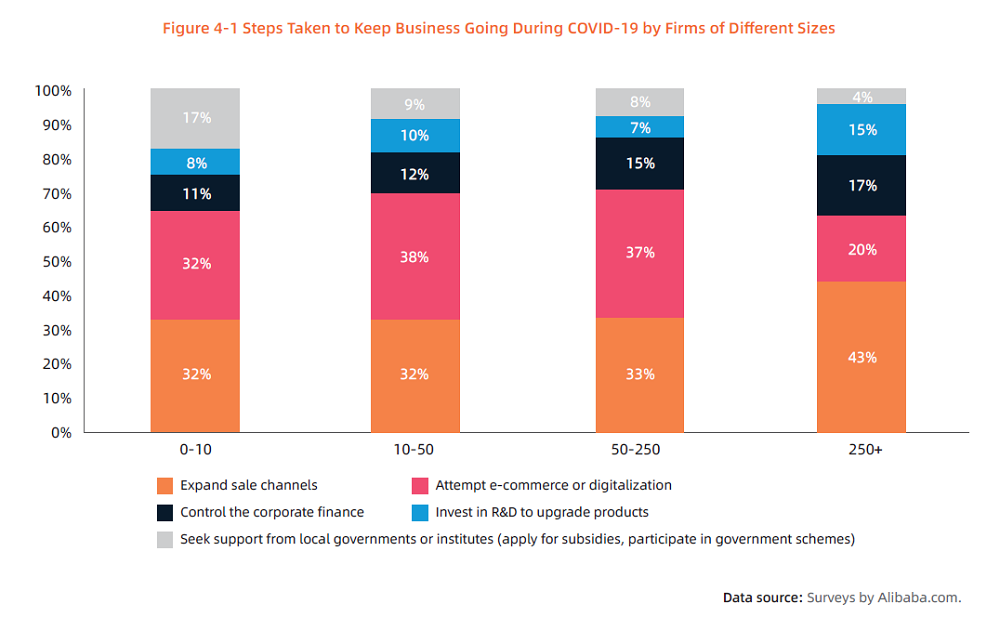

According to the survey responses, utilizing e-commerce was the top strategy for surviving the pandemic. Expanding sales channels came in as a close second.

Let’s take a closer look at how each of these survival mechanisms looked for MSMEs in the global trading spaces.

Expanding sales channels

Businesses were forced to get creative during the pandemic to keep their sales up. Those who had previously relied on their brick-and-mortar showrooms and other dated sales were forced to get creative.

B2B e-commerce marketplaces, such as Alibaba.com, have become a valuable resource to many traders. However, these platforms represent only one element of a multichannel sales strategy.

Direct-to-consumer (DTC) sales can also play an important role in a sales channel expansion. As the name suggests, it involves selling directly to consumers with no middleman. This can be facilitated via e-commerce, traditional sales, or social selling.

Coincidently, social selling is another important element of multichannel sales. Social selling involves selling through social media sites. As social media platforms continue to evolve, many are adding dedicated commerce tools that enable businesses to sell products right on their social profiles.

E-commerce and digitalization

The pandemic has served as the driving force of digitalization in global trade. Before the pandemic, e-commerce was already prevalent in B2C retail, but the pandemic changed the game for B2B trade, especially when it comes to cross-border trade.

Some of the first major restrictions in the early days of the pandemic were restrictions on travel. Since business people couldn’t travel to meetings, conventions, and trade shows to carry out deals, as usual, they were forced to rely on digital means.

The rapid growth of B2B e-commerce1 came as a result of the dire need for digitalization. It allowed businesses to take their operations online. B2B e-commerce marketplaces, such as Alibaba.com, helped to make this process quite seamless.

Controlling finances

There are two ways to increase your profit: cut your expenses or make more sales. Since many businesses struggled to even maintain sales during the pandemic, cutting expenses became the only option.

Businesses were forced to assess what’s most important to their business operations and cut costs accordingly. Some ways that businesses cut costs2 to control their finances included:

- Closing offices

- Laying off employees

- Optimizing operations

- Severing contracts with freelancers

- Unsubscribing from software and services

For some businesses, these actions were permanent, and for others, it was temporary. Most did what they had to do to survive.

Investing in R&D

Sticking out amongst the competition has never been more important. Many businesses have invested in research and development (R&D) in order to keep up with and surpass the competition. By investing in R&D, businesses can improve their products, optimize their process, and expand their services.

Investing in R&D will have different returns in different situations. For example, investing in optimizing your processes can raise your bottom line by saving money. On the other hand, investing in product development can provide the leverage you need to raise your prices or appeal to a larger audience.

Local government aid

Many governments and other institutions offered aid to businesses throughout the pandemic. The idea was to help businesses stay afloat to reduce unemployment. Many businesses received thousands to millions of dollars in aid over the course of the pandemic.

The United States, for example, had several financial aid programs for businesses throughout the country. The Small Business Association, which is an organization backed by the U.S. government, rolled out an initiative called Payroll Protection Program (PPP). It was a forgivable business loan to help businesses pay their employees.

There were a ton of similar programs offering small business aid across the EU, as well. Each institution and organization structured its emergency funding a little differently.

The importance of E-commerce through and beyond the pandemic

Alibaba.com has served as a valuable resource to many businesses over the course of the pandemic. It has helped businesses move their operations online in order to stay afloat during the pandemic. Not only does Alibaba.com serve as an e-commerce marketplace, but it facilitates trade in a way that improves accessibility for businesses around the world.

Alibaba.com hosts virtual tradeshows and other digital sales events to help businesses come together to form professional relationships. Plus, Alibaba.com offers smart communication tools that auto-translate conversations which makes it possible to overcome language barriers and connect with more potential trade partners.

These and other tools from Alibaba.com have helped businesses break into the digital space and survive the pandemic.

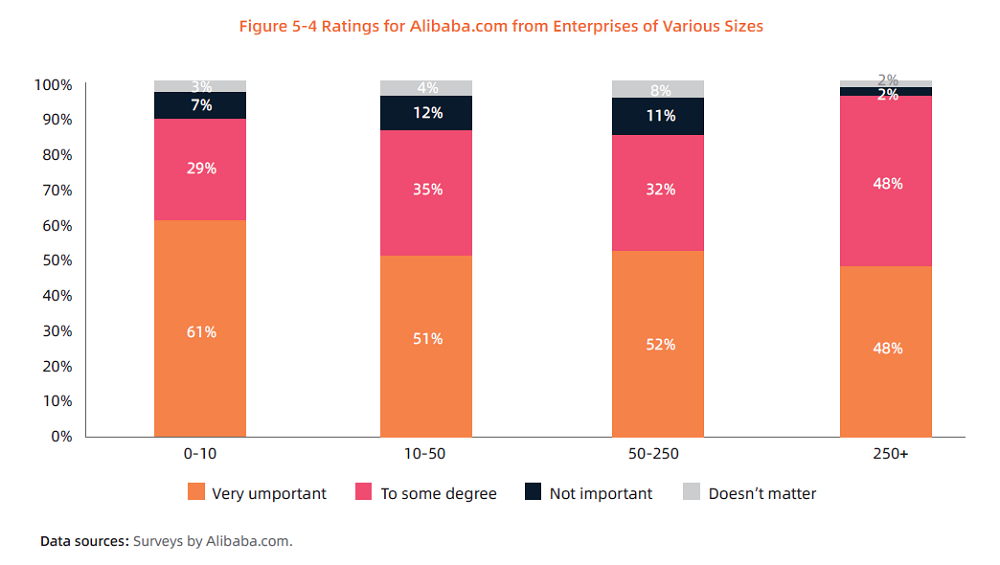

In general, 55% of customers who responded to the survey think e-commerce marketplace like Alibaba.com is still of great value to MSMEs after the pandemic, and 32% of customers reported that it still has some value to their operations. That means that a total of 87% of respondents had a positive take on Alibaba.com as a part of their post-pandemic operations.

Let’s take some time to look closer at the importance of e-commerce marketplace for MSMEs by company size and type.

The importance of E-commerce to MSMEs by company size

Among businesses with up to 10 employees, 58% of survey respondents say that B2B e-commerce platform like Alibaba.com remains very important even as the pandemic becomes less of an issue. Just under a third of businesses of that size claim that Alibaba.com is relevant to some degree, and only a handful say that the B2B e-commerce platform has become irrelevant with the passing of the pandemic.

Respondents with 10 to 50 and 50 to 250 employees had almost identical results. Among those with 10 to 50 employees, 51% responded that B2B e-commerce platform like Alibaba.com remains very important, 35% responded that it remains somewhat important, 12% responded that it is not important, and only 4% responded that the e-commerce platform does not matter.

Among the companies with 50 to 250 employees, 51.7% responded that B2B e-commerce platform like Alibaba.com is very important, 32.5% said that it was somewhat important, 10.7% reported that it is no longer important, and 8% report that it doesn’t matter.

However, about half of the respondents with more than 250 employees answered that B2B marketplace like Alibaba.com remained important, and the other half said that Alibaba.com was still relevant to some degree. Only 1 of the 45 respondents with 250+ employees said that e-commerce marketplace was no longer important.

From this data, we can also see that the majority of respondents see value in continuing to use B2B e-commerce like Alibaba.com to support their businesses post-pandemic. Since nearly 98% of businesses with over 250 employees responded that Alibaba.com will still be at least somewhat relevant after the pandemic, we also see that the platform is considerably more important amongst larger MSMEs.

The importance of E-commerce to MSMEs by business type

According to the survey responses, Alibaba.com was just about proportionately important to each business type. The responses from distributors varied the most from the other results, but not by much.

Almost 50% of manufacturers, 58% of trading companies, 67.6% of distributors, and 58% of entrepreneurs reported that E-commerce platform like Alibaba.com remains very important to their companies. Based on these responses, Alibaba.com seems to have been the most important to distributors.

On the flip side, less than 4% of manufacturers, 5% of trading companies, 1.4% of distributors, and 2.7% of entrepreneurs said that B2B e-commerce platform no longer matters to their companies. Again, the least negative response was from distributors.

MSMEs’ expectations for future support

Many MSMEs turned to external resources in order to make it through the pandemic. Governments and other major organizations around the world worked hard to accommodate businesses to help them stay afloat.

The various types of aid helped to shape the business landscape to create more favorable conditions for B2B traders.

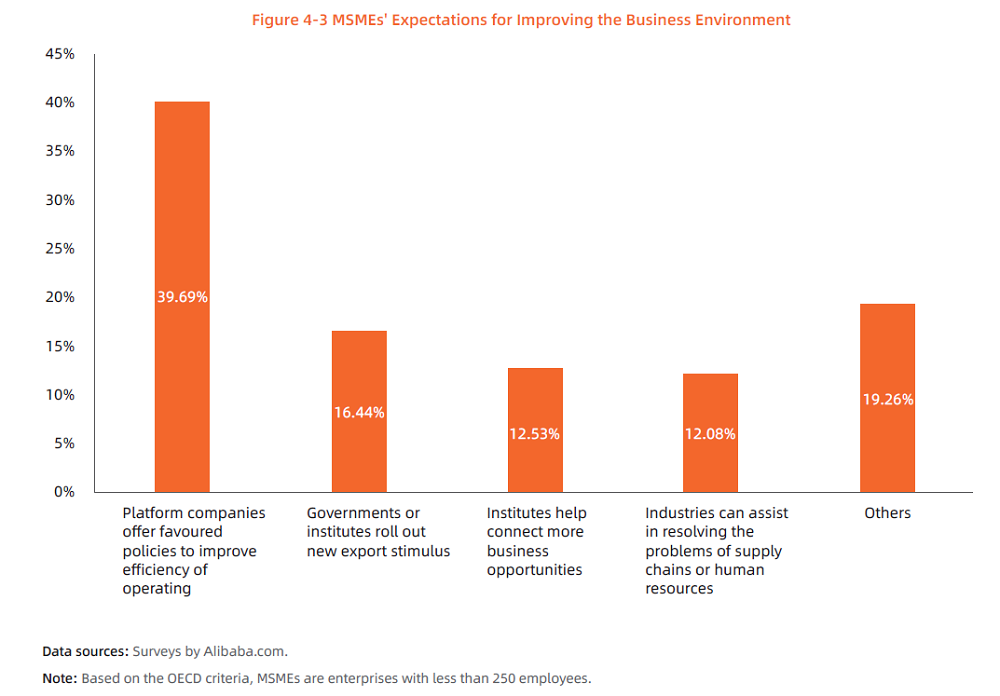

Among all of the respondents, the most popular expectation for future support is that platforms, such as Alibaba.com, continue to offer accommodations and policies to improve the efficiency of business operations. In fact, nearly half of the respondents had this opinion.

The other half of the responses were split almost equally. They stated that their expectations for future support were focused heavily on government organizations, industry leaders, and other institutions. The results were proportionate when the respondents were broken down by size.

These expectations include export stimulus programs from governments and other institutions, assistance in resolving the problems of supply chains or human resources, and connection facilitation from institutions to create more business opportunities.

Conclusion

Although the effects of the pandemic are lessening with time and most of the world is operating as normal, the lessons we’ve learned throughout this global crisis will stick with businesses for generations to come. Many MSMEs have faced tremendous hardships, but the experience has left them better equipped to navigate tough situations moving forward.

If one positive has come from this situation, it is the shift towards e-commerce in B2B trade. With the digitalization of B2B trade comes brand new opportunities for buyers and sellers from around the world.

Digitalization makes trade more accessible and affordable since businesses can connect over the internet without having to travel to tradeshows and other events. Plus, with the support of Alibaba.com, global B2B trade is easier than ever.

References:

1. https://www.bigcommerce.co.uk/articles/B2B-ecommerce/B2B-ecommerce-trends/

2. https://www.abfjournal.com/articles/how-companies-are-cutting-costs-during-the-covid-19-pandemic/

Start your borderless business here

Tell us about your business and stay connected.

Keep up with the latest from Alibaba.com?

Subscribe to us, get free e-commerce tips, inspiration, and resources delivered directly to your inbox.